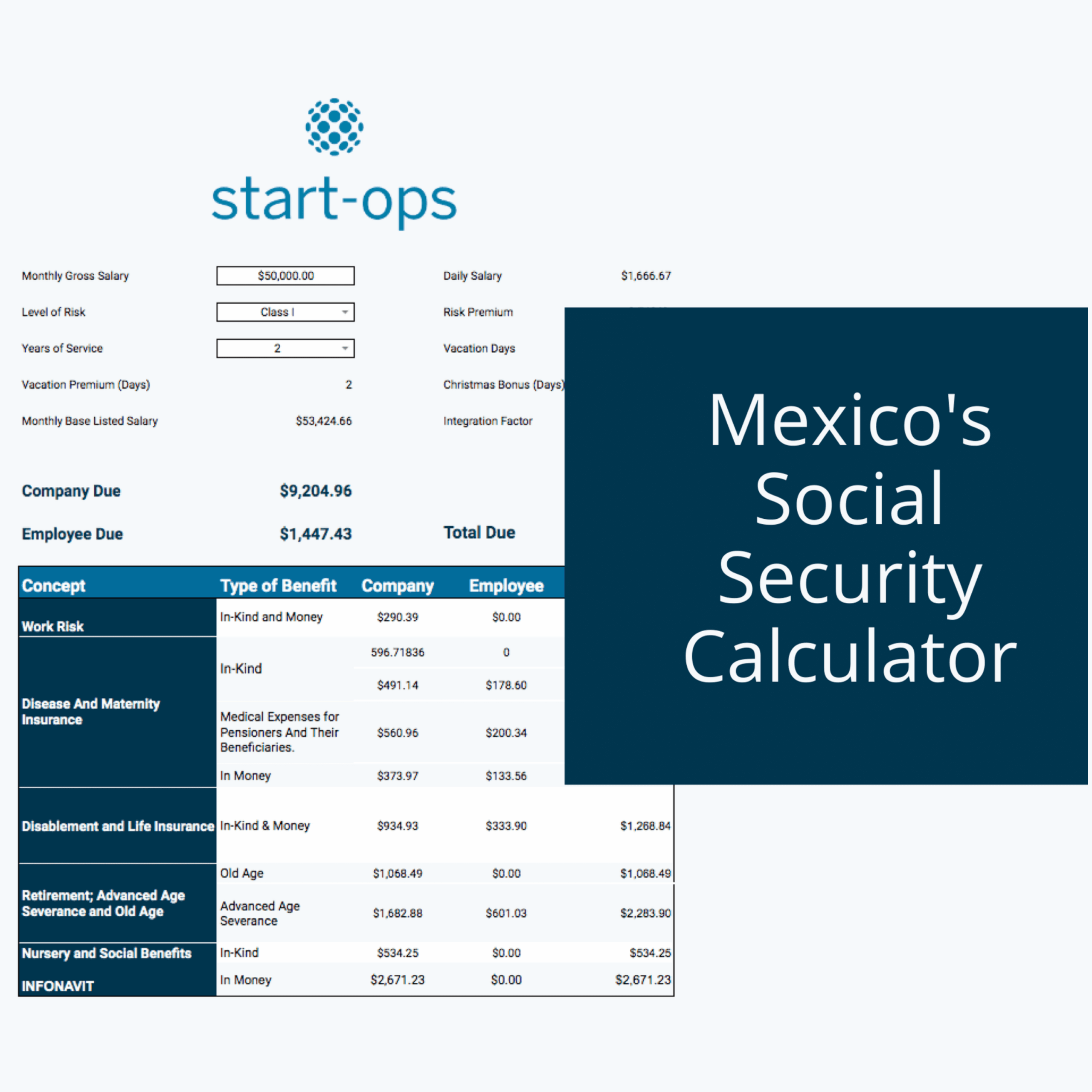

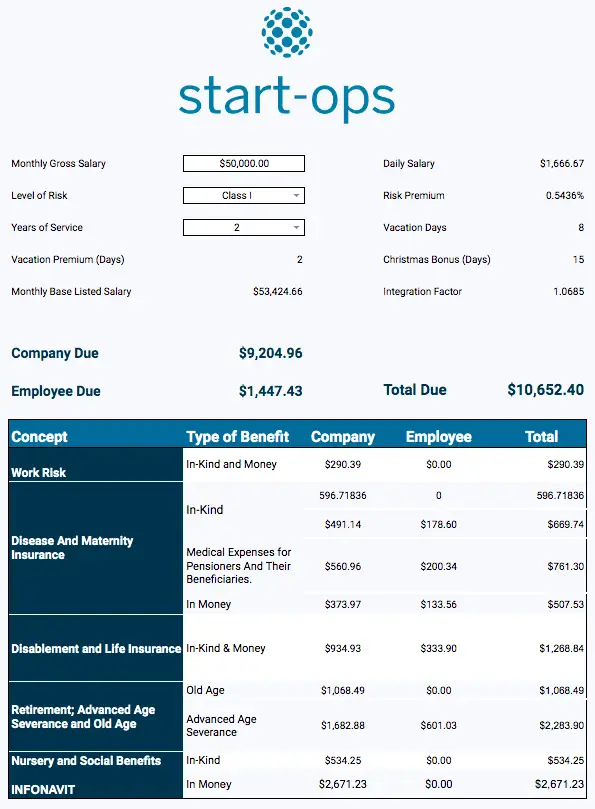

IMSS Social Security Calculator

Original price was: $49.99.$0.00Current price is: $0.00.

Free Tool!

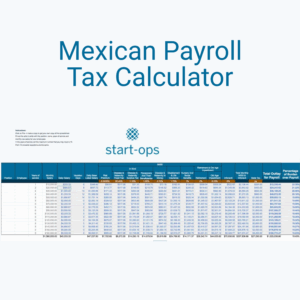

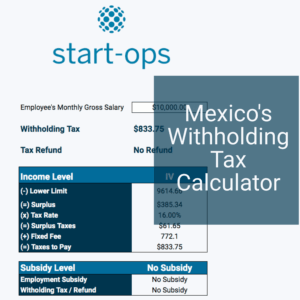

Navigating Mexico’s social security system can be a complex process. Our IMSS Contribution Calculator gives you a precise breakdown of mandatory employer and employee payments to the Mexican Social Security Institute. Ensure compliance and budget with confidence. Get your free, essential tool now!

Description

Ensure Full Compliance and Master Your Budget with Our IMSS Calculator

One of the most significant—and often confusing—costs of hiring in Mexico are the mandatory social security contributions to the Instituto Mexicano del Seguro Social (IMSS). These payments are non-negotiable and crucial for legal compliance. Our calculator is designed to eliminate the guesswork.

Built for foreign executives and HR managers, this tool provides a detailed forecast of the contributions required for each employee based on their salary.

What Does the IMSS Calculator Break Down?

- Employer Contributions (Cuotas Patronales): Understand exactly how much your company must contribute for each employee across the five mandatory insurance branches:

- Work-Related Risks

- Illness and Maternity

- Disability and Life

- Retirement, Severance, and Old Age

- Nursery and Social Benefits

- Employee Contributions (Cuotas Obreras): See the amounts that will be withheld from your employee’s salary, ensuring full transparency in your payroll process.

- Total Social Security Cost: Get a consolidated view of the total IMSS payment, allowing for precise budgeting and financial forecasting.

Who Needs This Tool?

- Companies Finalizing Their Mexican Budget: Move from rough estimates to hard numbers for your operational and hiring costs.

- Global Payroll & HR Managers: Run scenarios for different salary levels to inform your compensation and benefits strategy.

- Business Owners Entering the Mexican Market: Gain a foundational understanding of your legal obligations as an employer in Mexico.

Don’t let IMSS be a black box. Use our calculator to gain clarity, ensure compliance, and make smarter financial decisions from day one.

Download your essential IMSS Calculator today!

Reviews

There are no reviews yet.